Success in private credit investing is driven by avoiding losers rather than picking winners. This makes it crucial for private credit managers to be equipped with the right skills to minimize potential losses.

Private credit managers with debt restructuring experience have a significant advantage across all areas of credit investing – from sourcing and underwriting to monitoring and recovering value in distressed situations.

Restructuring experience provides investment managers with valuable historical data and the tools needed to avoid distressed investments. In the case a distress situation does occur, these managers have the knowledge and confidence to navigate challenging conditions, ensuring the best outcome for investors.

While the recent benign economic climate may have allowed many managers to avoid losses, this environment is unlikely to last. Avoiding distressed situations today will be key to maintaining stable returns should economic conditions decline and default rates rise.

In this insight, we explore how first-hand restructuring experience significantly enhances credit investing performance.

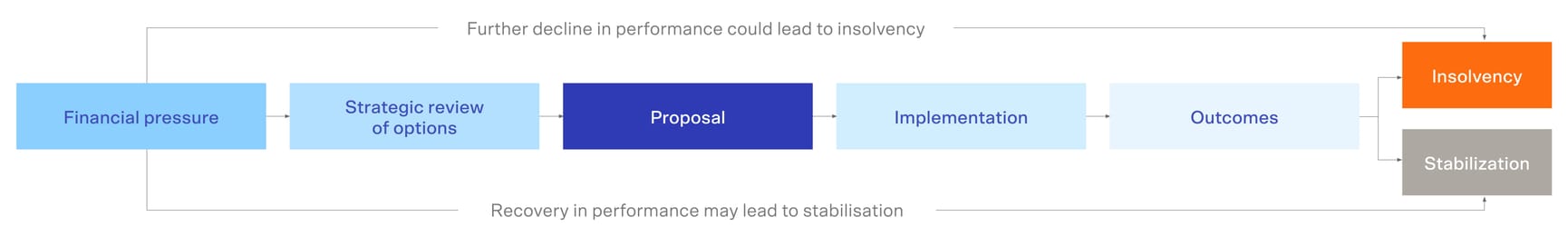

The four stages of company distress and debt restructuring

Restructuring transactions are complex involving deep operational insights and significant involvement in strategic decisions. This experience gives private credit managers a strong understanding of why businesses fail and key drivers of credit risk.

When a company is in distress it typically goes through four stages:

- Financial pressure: financial stress generally starts with an increase in leverage due to earnings decline, asset impairments or a sudden one-off event like the loss of a major customer contract. This stress weakens credit metrics and in more severe cases can result in covenant breaches or payment defaults

- Strategic review: as financial stress escalates, a company will explore a range of options to maximize value, including amendments to extend debt facilities, a sale of assets, divisions or the entire company as well as recapitalization or restructuring

- Implementation phase: here a company agrees on a strategy with the primary goal being to stabilize the firm in preparation for an operational turnaround or monetization e.g. via a sale

- Outcome: ideally the company is stabilized before an event of default or uncontrolled insolvency occurs. If a stabilization isn’t possible, a formal insolvency processes may result such as an administration or receivership.

Capitalizing on restructuring experience enhances private credit investing

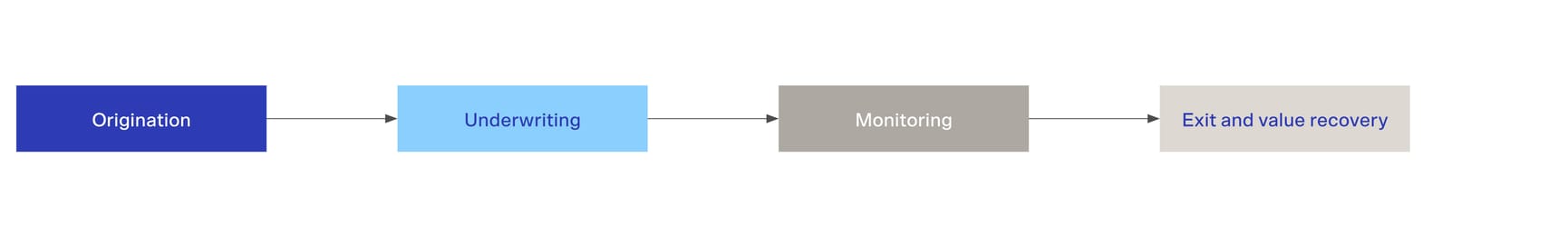

Private credit managers can apply learnings from restructuring transactions across the entire credit investment process, from origination to exiting a position.

Origination: spotting critical flaws early

A robust initial screening and filtering process is key to credit selection. Identifying key risk factors early in the process is important to avoid overlooking fundamental, high-level risks, and as such, a deep understanding of the features that often lead to distress is invaluable in screening investments.

Private credit managers with a background in distressed situations are better equipped at spotting critical flaws in transactions early and avoiding potentially loss-making situations.

Additionally, the ability to discern which risks can be managed and which are deal breakers is a key advantage gained from experience with distressed situations.

Underwriting: robust diligence and asking the right questions

A key part of the underwriting process is asking the right questions. This means going beyond surface level analysis to validate the thesis for an investment opportunity.

Through experience in distressed transactions, patterns start to form. Recognizing how to uncover key risks that can’t be mitigated greatly enhances a manager’s ability to avoid problem credit investments.

Restructuring experience provides detailed insights into the traits most valuable for assessing risk and guiding diligence efforts.

Underwriting: optimizing loan structuring and protections

Proper loan structuring is crucial for maximizing recoveries in stressed scenarios. Lenders rely on security and recourse over assets as part of their safety net. To protect capital, it is critical to optimize legal agreements and documentation to preserve control over the recovery process in the event of distress.

In a debt restructuring, company advisors will often exploit weaknesses in facility documentation which can harm lenders.

Restructuring experience equips lenders with knowledge such as recent market precedents to develop secure loan agreements, minimizing risks that may arise in future restructurings.

Monitoring: identifying distress early

Identifying potential distress before it escalates is crucial for effective portfolio management. Early recognition of warning signs allows managers to intervene proactively, and collaborate with borrowers on addressing operational challenges or raising additional capital.

Early intervention also creates options for a manager to reduce exposure before risks escalate. Delays in taking action often result in further performance deterioration and a narrowing of recovery options, ultimately limiting the potential to preserve value.

Exit and value recovery: knowing how to act

Knowing how to act when things go wrong is crucial to maximize loan recoveries.

A wide range of skills is needed, including:

- Strategic planning to evaluate all options

- Stakeholder and game theory analysis to predict actions and optimize outcomes

- Expertise in legal frameworks to navigate restructuring processes

- Capital markets knowledge to assess feasibility of raising capital or selling assets

- Decisive operational decision-making such as replacing management to prevent further value loss

- Coordination and leadership to rally support among all stakeholders and successfully execute the preferred proposal.

When these skills are available in-house, managers benefit from reduced costs and quicker decision-making, as external financial advisors often charge substantial fees deterring early engagement of experts.

Why restructuring experience is key

Restructuring transactions are complex and require specialized expertise. Private credit managers with a background in distressed situations are better equipped to spot critical flaws in transactions early and avoid potentially loss-making situations.

MA Financial’s Global Credit Solutions team brings extensive experience in debt restructurings, with deep expertise integrated into both investment and portfolio management processes.

Members of the team including those on the investment committee, have collectively advised on more than $40 billion of debt restructurings1 playing key roles in some of the largest and most transformative transactions in the Australian market.

Through MA Financial’s corporate advisory division, MA Moelis Australia, the team benefits from direct access to the number one ranked restructuring advisors in Australia and the US2 ensuring unparalleled insights and strategic advantages for investors.

1. Experience includes via prior Corporate Advisory roles at MA Moelis Australia (division of MA Financial Group).

2. LSEG/Refinitiv, as of FY 2023 – announced and not withdrawn $ volume excl. sovereigns.

Important Information: This material has been prepared by MA Investment Management Pty Ltd ACN 621 552 896 AFS Representative Number 001258449 (MA Investment Management). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MA Investment Management. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MA Investment Management, MA Financial Group Limited (MA Financial Group) or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MA Investment Management and MA Financial Group, has any responsibility to update any of the information provided in this material.