Real estate is a fundamental asset class in any portfolio, and many investors have exposure through their primary residence. As an asset class real estate has consistently been a wealth creator over generations due to its finite supply, particularly in desirable locations.

In this insight, we explain why we think now is the time to increase allocations and position portfolios to capitalise on a once-in-a-cycle buying opportunity.

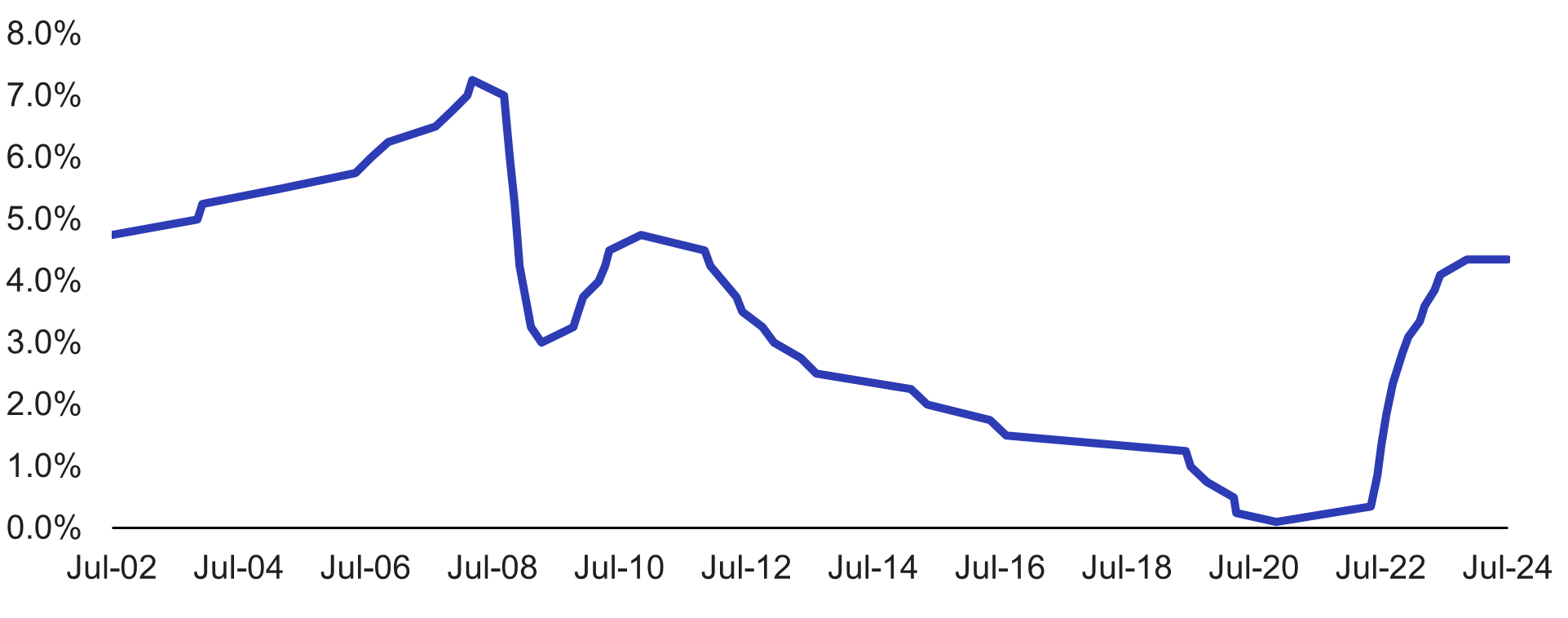

Rising interest rates have impacted real estate values

Over the past 18 months, the real estate market has undergone an adjustment on the back of the most aggressive interest rate tightening cycle on record, causing the cost of debt financing to triple in many cases.

In 2020 all-in financing costs were at around 2.0% per annum, while today the cost is 6.0-6.5%.1

Given interest expense is a meaningful part of real estate funding, real estate values have been impacted significantly, readjusting downward to reflect the current cost of debt and the required premiums for asset returns. This has created immense pressure on capital or funding structures (for some owners) who acquired and funded assets at very low rates and now have limited access to new equity and need to sell.

Over the past 18 months, the market has mostly been stagnant with sellers expecting high prices and buyers cautious due to uncertainty and higher interest rates. This is evidenced by transaction volumes last year being only ~$23bn2 versus $52bn in 20213, the year before interest rates started to increase.

Australian transaction volumes – 2018 to 1H 2024

CBRE Research 2024.

Scarcity of capital across the board

The market is simultaneously contending with limited capital available for investment.

There is a high level of uncertainty, and many real estate investors are dealing with overvalued investments.

Real Estate Investment Trusts (REITs) are trading at a 30% discount to valuations, with many valuations still high, and unable to raise capital or debt. Listed REITs, which are usually a significant buyer in the market are now more likely to sell assets due to elevated gearing levels.

Domestic institutional investors are inactive as they manage legacy issues in their portfolios and typically move later in a cycle.

Internationally, decision-makers tend to stay closer to home due to their familiarity with local market dynamics and the ability to access attractive returns without venturing abroad. In many cases, such as in the US, leverage is higher than in Australia leading to higher cyclical volatility and more distressed opportunities.

International capital was also at its lowest level in over six years at $5.8bn with nearly 50% allocated to the living and hotel asset classes.4

Private investors and syndicators are currently the most active although transactions remain well below historic levels. We have seen this with several syndicators active in the market, especially in the retail shopping centre asset class and some alternative real estate.

Where to for interest rates, and the importance of a long-term view

We believe the interest rate cycle is coming to an end (see charts below). We believe we are now in a more normal interest rate environment, and the low rates of the recent past were unusually low.

RBA Cash Rate – 2002 – 2024

RBA – Statistical Tables (Monetary Policy Changes – A2).

While there are various views about where to from here, we believe rates will remain reasonably steady for the immediate future with some concerns the consumer is starting to show signs of weakness although inflation remains sticky.

To this point, there is a hedge if the economy gets weaker as the Reserve Bank of Australia will move to sure up households which will put downward pressure on rates and be good for real estate valuations.

The interest rate pendulum is currently neutral with the next movement being up or down finely balanced. If rates were to rise another 25-50bps, that would impact short-term sentiment. However, real estate investing is about the five to 10-year views as opposed to six monthly and we believe the longer-term view is that rates are peaking around the current levels.

With rates peaking and capital scarce we believe we are seeing once-in-a-cycle pricing for acquisitions.

For investors selective in opportunistically acquiring real estate today and who can operate or manage the asset well, the entry point will underwrite future returns.

Are we at the bottom?

No one can ever be sure whether pricing has bottomed, although several data points validate good buying.

It’s often underestimated how long it takes to put an attractive transaction together. Patience is needed to secure the right terms and that can take six to 12 months to complete, meaning timing is difficult to manage.

Currently, there is generally either one buyer or no buyers to compete with on asset acquisitions, although that can change quickly. We believe as the interest rate cycle rolls over capital will return and create greater opportunities for vendors and support better sale terms.

Entry price is key for outsized returns

In establishing the right foundations for outsized returns the key is the entry price – this is the main determinant of future returns.

When we think about entry price we think carefully about supply and demand.

In the case of real estate, the value thesis relates to the use of the land and the improvements built on the land.

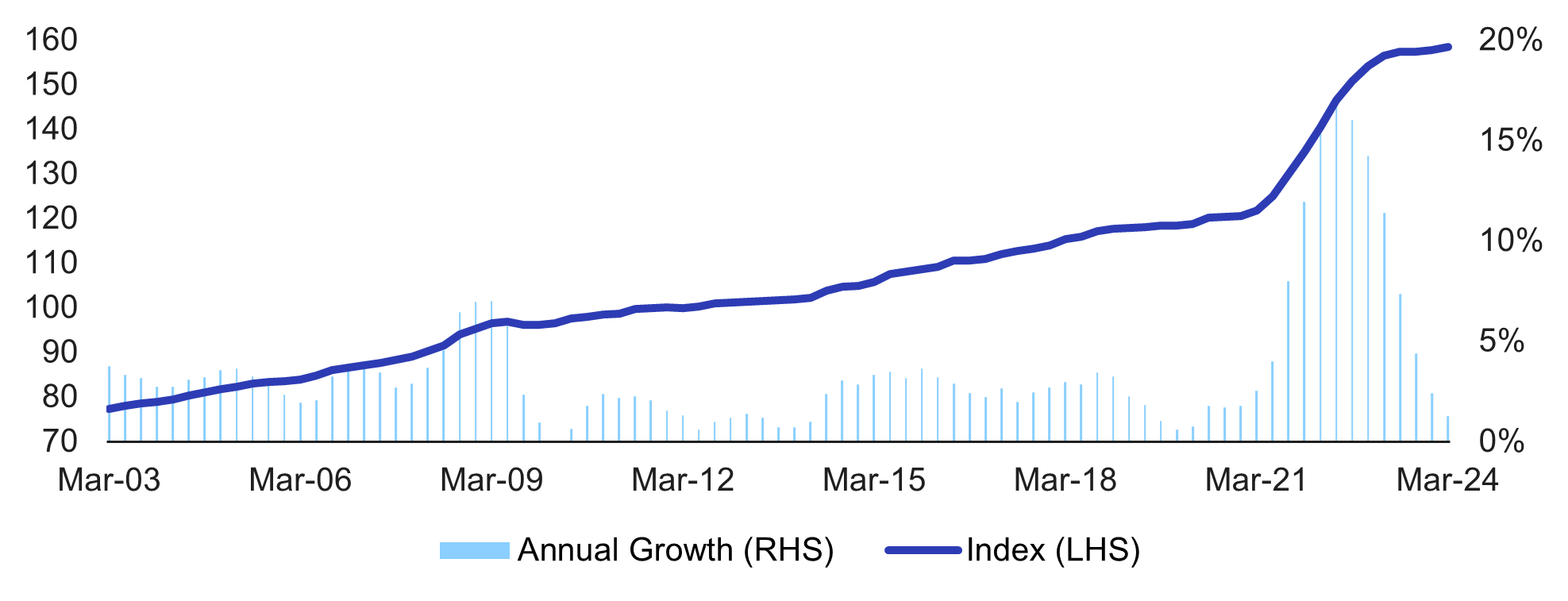

For future supply, the economics must add up for new supply to be developed. One of the key determinants is construction costs, and these costs are up materially which makes the completed product very attractively priced compared to new development.

Construction costs – 2003 – 2024

Australian Bureau of Statistics [6427018] – Producer Price Indices include timber, ceramic products, cement products, steel products, other metal products, electrical equipment, installed gas and electricity appliances and other materials.

In nearly all instances, we are looking at buying real estate at significant discounts of 20-30% to replacement costs based on building or construction costs alone. This ignores the value of land, development margins, and financing costs which would be expected to add a further 10%-15% to this analysis. Essentially, we are trying to buy high quality real estate at 30-50% discount to replacement cost.

The importance of this measure is it indicates there will be limited new supply in the medium or long term, and that protects the asset from any new competition. This is unless the fundamental performance of the asset supports the replacement costs. Either way, the investor wins, and the downside related to supply is protected.

If you have this downside covered, the demand side is key. There is no general commentary that applies for all real estate sectors except that Australia remains “the Lucky Country” with a robust economy, solid foundation of law and strong population growth all supporting long-term trends.

As most know, a specific real estate opportunity is all about location and the demand from businesses or residents to use that asset. That is what we are very focused on when assessing a specific opportunity.

Why tailwinds for demand are important

We are always looking for asset classes with strong tailwinds for demand. This needs to be considered in the context of new supply to understand the potential for new competition, although macro tailwinds are always helpful.

In pubs, the non-discretionary nature of spending relative to other entertainment offerings is defensive, and wage growth, immigration, and population growth all support demand for the offering.

In the case of marinas, while the number of people using marinas is very small, when considered against the macro trend of wealth and experiential expenditure and the severe lack of ability to bring on new supply, the fundamentals are very positive.

The undersupply of retail shopping centres in Australia against a growing population, wage growth, and an inflationary environment all support retail sales and turnover, and when considered against the low level of expected supply positions investors well. The key here is understanding the specific demographic of the shopping centre and its catchment.

In accommodation hotels, the entry price is key coupled with improving demand (tourism and business) following the global pandemic shock. Australia remains a highly attractive destination and people looking to consume experiences support the tourism industry.

Why now is the time to invest

At MA Financial we are constantly combing the real estate sector – both operational and core real estate assets where we have deep expertise – looking for anomalies that support outsized returns for risk.

At this point in the cycle, the lack of available capital leaves many sellers without buyers for their assets. Unfortunately for some sellers, they are required to sell for a variety of reasons – these are transactions we focus on.

The ability to create value from tightening capitalisation rates is over, and operational capability and active management are required to add value.

While many investors are nursing scars of the prior cycle and investments made at higher valuations and lower interest rates, now is the time to increase allocations and position portfolios to take advantage of the market as it improves.

While the press will continue to report negatively on the sector as many data points reflect historic deals or transactions from the last cycle, now is the time astute investors will capitalise on today’s current cycle pricing.

For more information about our real estate and hospitality solutions, please get in touch.

- RBA.

- CBRE Research 2024.

- CBRE Research 2024.

- CBRE Research 2024.

Important Information: This material has been prepared by MA Asset Management Ltd (ACN 142 008 535) (AFSL 327 515). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. Any investment in a fund managed by MA Financial Group is subject to the terms and conditions of the relevant fund offer document. This material and the information contained within it may not be reproduced or disclosed, in whole or in part, without the prior written consent of MA Asset Management Ltd. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MA Asset Management Ltd. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Actual events or results or the actual performance of MA Asset Management Ltd or an MA Asset Management Ltd financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MA Asset Management Ltd, MA Financial Group or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MA Asset Management Ltd and MA Financial Group, has any responsibility to update any of the information provided in this material.