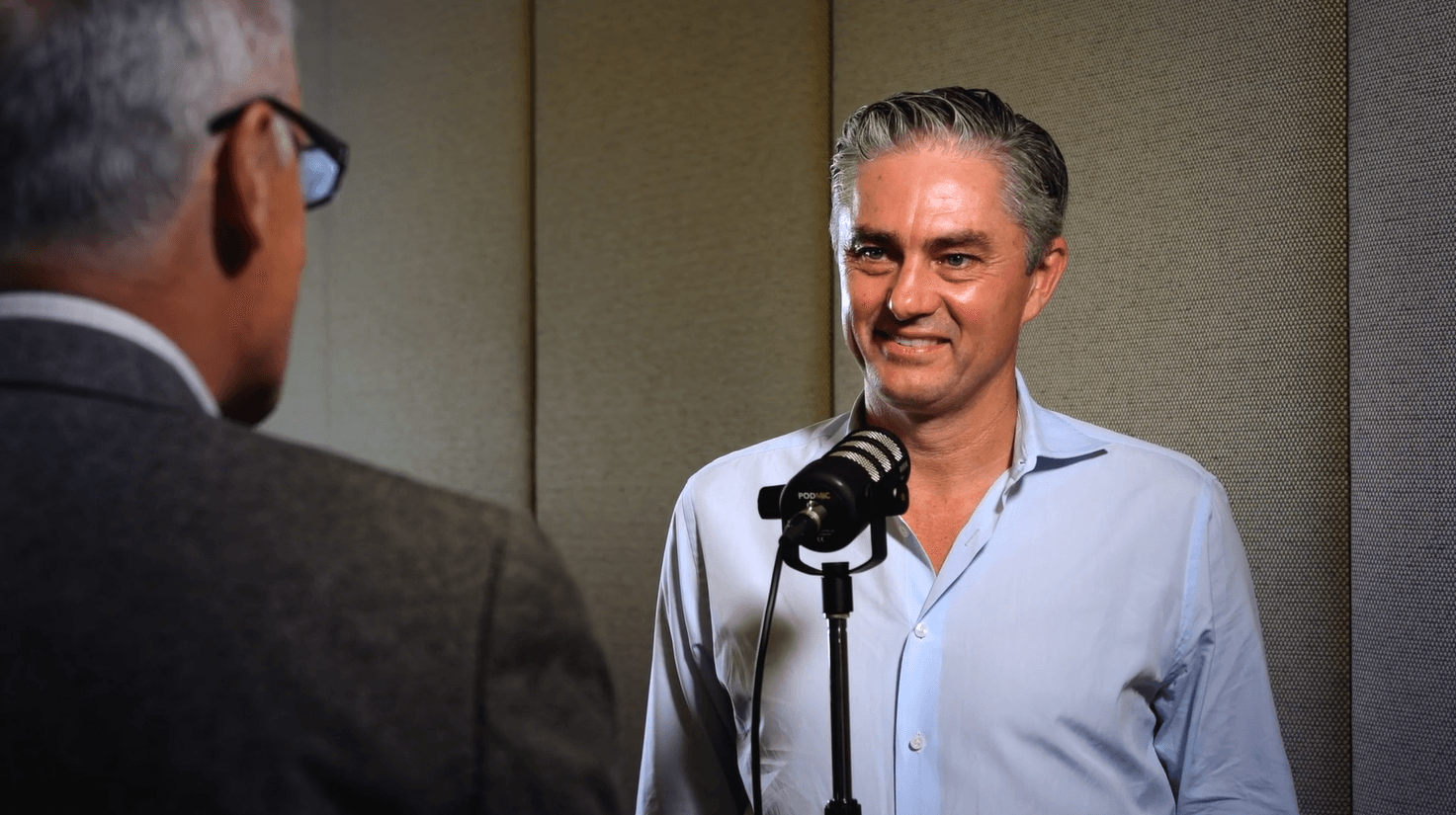

We were delighted to partner with The Inside Network at their recent Alternatives Symposium where our Joint CEO Julian Biggins explained the once-in-a-cycle buying opportunities we’re seeing in Australia’s ~$235 billion alternative real estate market.

In a short Q&A video recorded at the event with The Inside Network Contributing Editor James Dunn, Julian offered insight into a range of topics including how scarcity of capital is creating investment opportunities, and why less mature/institutionalised subsectors present inefficiencies and opportunities to earn outsized returns.

Julian also explained given real estate valuations lag reality how we seek to ensure we capitalise on opportunities at the right moment rather than being caught in a cycle of mispriced assets.

“…it's about doing your proper due diligence…We've got a team of 10 people sitting in alternative real estate alone. There's probably 150 people sitting across real estate and when you when you operate in the private markets, you get access to every bit of information. So you're doing a deep dive into the fundamentals, the cash flow, legalities, regulatory risk, and you can really understand the asset very well. And you price it on fundamentals. You don't price it on historic valuations.”