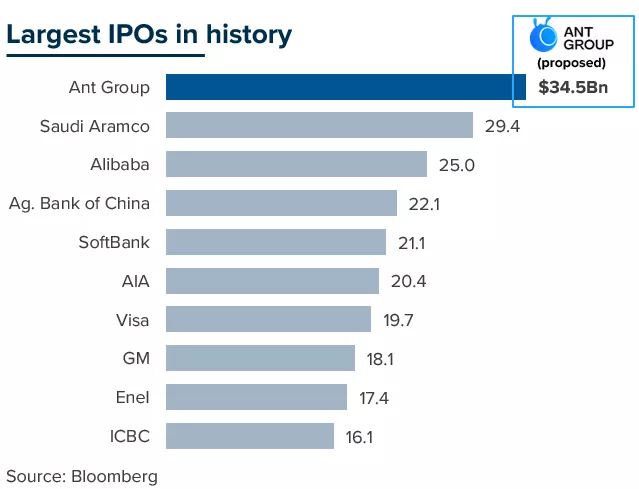

In ordinary times, seeing the largest IPO in history – which was raising a staggering US$35 billion at a nearly US$320 billion valuation1 – be halted two days before listing would have been front page news.

But these are not ordinary times. Amid a nail-biting presidential race, a milestone development towards a COVID-19 vaccine and big see-saw swings across markets in recent weeks, you could be forgiven for missing what happened with Ant Group.

Ignoring Ant, however, would be a giant mistake.

Not for the IPO drama. Nor the immense demand for stock in this business, including the US$2.8 trillion – yes, trillion with a T – in bids from five million retail investors in its IPO bookbuild2 (for some perspective, that’s over two times the size of Australia’s entire economy!).3 And not merely because of the incredible pace of Ant’s growth (it now facilitates $17.7 trillion in digital payments annually in China for over one billion people, up 72% since 20174), or its sheer scale (Ant’s loan portfolio is now $323 billion5 and its investment fund offerings total $615 billion6).

This is all interesting, but a distraction from the true lesson of Ant Group.

A financial supermarket reshaping the industry

Ant’s business model – whether now, or a few years from now – is the one we believe will fundamentally reshape the world’s financial services industry.

It upends the way consumer lending is done and how people manage their finances.

Ant is not a bank. It is not really a lender, either. Think of it like a financial supermarket.

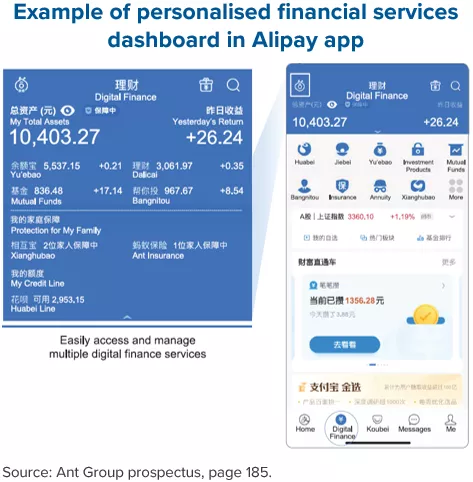

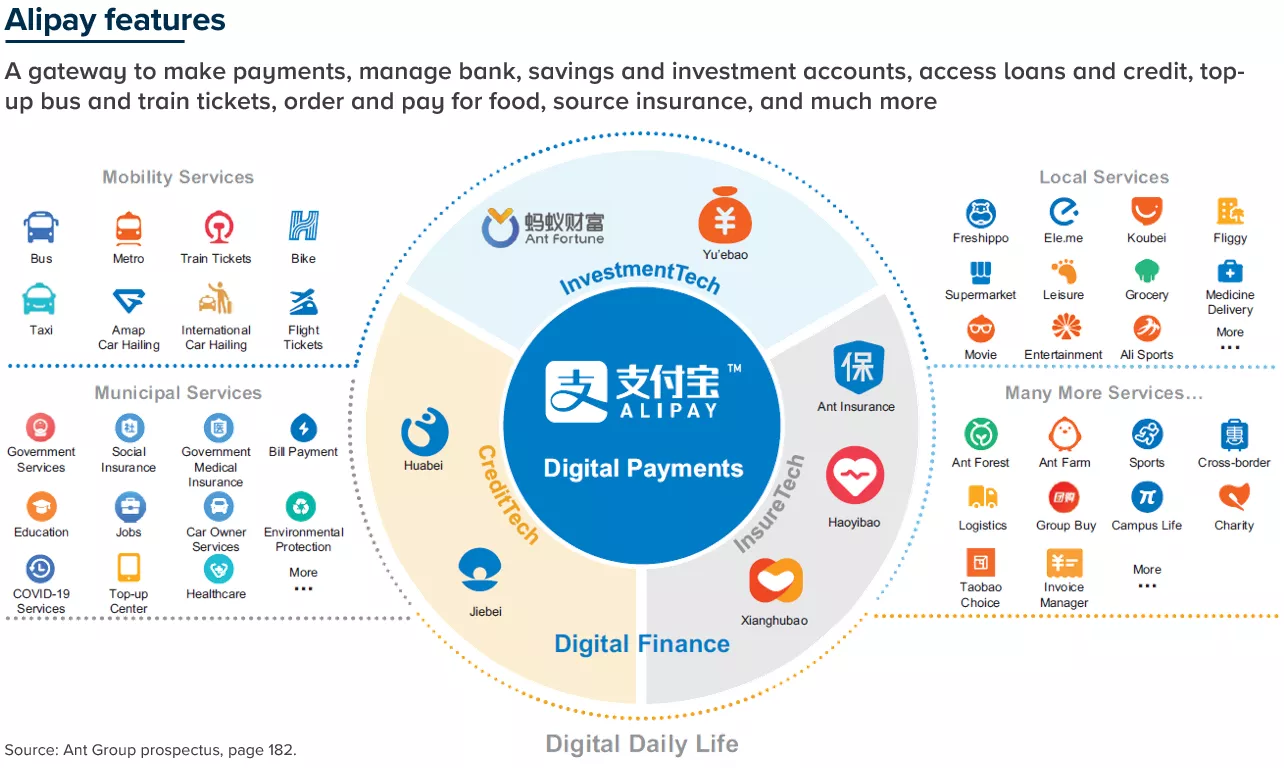

It operates the infrastructure through which 711 million people in China connect each month with over 2,000 partner institutions to manage their money, make payments, obtain loans, find savings or investment products, source insurance and arrange many other life services.

This model – being the financial infrastructure, or ‘gateway’ – is capital light, profitable and hugely scalable.

We believe the model will eventually come to markets like Australia, the US and Europe. It will be technology-led. And it will transform the way financial services works for ordinary people all around the world.

Let us explain.

Firstly, what is Ant Group?

Ant Group owns Alipay, which is China’s largest digital payment platform.

Alipay was established in 2004 as an escrow service between buyers and sellers on Alibaba, to solve what it called the ‘trust gap’ in online transactions. (Alibaba, if you don’t know, is like a combination between Amazon, eBay and all your favourite online stores. It now accounts for over half of all online shopping sales in China.7)

Alipay became ubiquitous in China by launching a mobile app in 2009 that allowed Chinese businesses to easily accept payments through QR codes and consumers to have a digital wallet to transact online and offline. Alipay was spun-out as an independent company in 2011.

The ‘gateway approach’ – invert the market as financial infrastructure

Since then, Alipay has transformed itself from an easy way to make digital payments into a financial juggernaut. It has a fly-wheel model:

- People use Alipay for digital payments. A lot of people. It has 711 million monthly active users and over 80 million merchants on its platform. The $17.7 trillion in payments it facilitates each year is 2.8x more than Mastercard handles worldwide8 and over half of all digital payments in China.9 Ant has a payments duopoly with Tencent’s WeChat app

- Payments is run as thin margin but drives use of the platform. It means consumers and businesses are always in its app, for both online and offline commerce. In fact, we estimate payments is a loss leader for Ant Group10

- This builds customer trust and brand loyalty

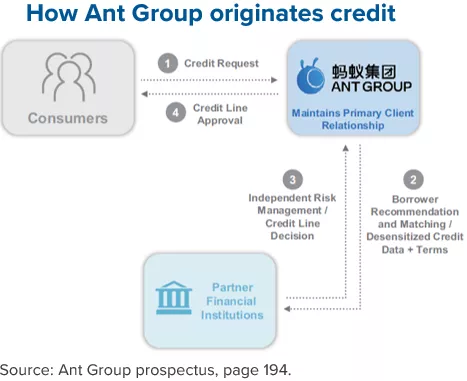

- Alipay then allows people and businesses to access a range of other financial products, all through its app. The platform is a gateway to get a loan, access credit, invest money, buy insurance, and more. This becomes a sticky and virtuous cycle. The more people transact on the platform, the more likely they are to use it for other services. However, the customer’s relationship is with Alipay, not the bank, lender, insurer or financial institution

- Alipay does origination and AI-based underwriting but doesn’t use its balance sheet. The wealth of data Alipay has enables it to underwrite financial products and match customers with institutions based on their profiles and needs. It earns fees for doing this, but isn’t scale limited by its own balance sheet, nor taking credit risk. It allows other banks and institutions to manage that. As proof, 98% of credit balances originated through its platform were either funded by partner institutions or securitised.11 With fees linked to value of loans, assets and insurance managed through its app (currently ~1.3%12), and a scalable cost base, earnings expand substantially as people use the gateway to manage more of their finances.

Why TechFin and not FinTech is the revolution in financial services

There are huge amounts of speculative money, matched with eye-watering valuations, betting on the ‘fintech’ sector. It is one of the hottest spaces chased by venture capital today.

We’re sceptical that most fintechs have the right model. Unlike software, for example, balance sheet lending is a capital intensive and doesn’t scale well without lots of ongoing investment.

This is especially hard with margins compressing in a low interest rate world. It’s even harder when competing with large global institutions, which are already at scale with huge customer bases and established distribution channels. In lending, we stick to the old proverb, “there’s riches in niches.”

The truly revolutionary model is not to be an online balance sheet lender or financial institution.

It’s to invert the market and be the central infrastructure that allows digital lending, or any type of digital finance, to happen.

In the words of Jack Ma, Ant’s founder, “Fintech takes the original financial system and improves its technology. TechFin is to rebuild the system with technology.”

In other words, fintechs are just an evolution of financial services as is already done today. They make the same thing more efficient with technology.

The revolution in financial services, however, is TechFin. It is fundamental reform of a long-established system with an entirely new architecture for the way finance should done.

We believe that, in the future, there will be a small number of technology ecosystems through which people manage their finances. These ecosystems will act as the portal for most people to access loans, make investments and buy financial products (like insurance) in a simple, transparent and much-more standardised way.

Banks and incumbent financial institutions will be transformed into mere commodity capital or product providers. And those institutions won’t ‘own’ customer relationships anymore. The customer relationship will be with the gateway.

This is a fairer system, less hamstrung by antiquated constructs and legacy frameworks about risk and pricing (which are largely guesswork). It will be data, machine-learning and artificial intelligence driven. And, importantly, customer-outcome focused.

But what about Ant’s failed IPO?

Financial services is heavily regulated, so innovation in the sector has the added complexity of navigating a myriad of legal rules – many of which have yet to evolve for a digital world. Finance is also a sensitive area for central governments and regulators.

The recent moves by China’s regulator to add requirements for Ant Group to fund more of its loans (rumours13 say 30%, up from only 2% today) on its balance sheet and regulate it more like a bank, which halted its IPO, only highlight how serious this risk can be for both FinTechs and TechFins alike.

In 2008, Jack Ma famously declared: “If the banks don’t change, we’ll change the banks.” Now, he’s at risk of being regulated like one. A heavily regulated utility doesn’t have the same flair as TechFin.

Why regulation is only a comma (and not a full stop) to innovation

However, we look at it this way. Regulation can curb the speed of innovation. It might even be good to manage the pace that cutting-edge advancements occur, to avoid major systemic risks emerging. But not even regulation can reverse the winds of secular change. Taxi regulations didn’t stop the emergence of Uber and ride-sharing. Eventually, a harmony is achieved between innovators and regulators – especially when the ultimate outcome is good for consumers.

Why TechFin is the way of the future

The ‘gateway approach’ – being the financial infrastructure – is a technology-esque business model. The platforms that thrive will have:

- deep customer trust and a culture of customer-centricity

- large reach with embedded access to customers and institutions

- great access to data and powerful analytical capabilities.

Trust, Reach and Data. This gravitates toward technology ecosystems as the central platforms in a new way for people to manage their finances.

Ant Group’s Alipay is, we believe, a roadmap for Apple, Google, Facebook, Amazon and other tech giants to grow into financial services. That is an exciting prospect for customers. And a downright terrifying proposition for incumbent financial institutions.

Right or wrong in our thesis, we look forward to seeing how this plays out in the coming years.

- William Blake

1 All figures in this article are in US dollars.

2 Ant Group press statement. Wall Street Journal article, ‘Ant IPO Sets Off $3 Trillion Scramble Amon Small Investors’ (30 October 2020), by Joanne Chiu.

3 Based on GDP for the 12 months to 30 June 2020, per ABS data. Australian dollars converted to US dollars for comparison to US$2.8 trillion demand figure at 0.70.

4 As at 30 June 2020. Source: Ant Group prospectus, page 168. RMB118 trillion converted to USD at an exchange rate of 0.15. Growth based on disclosures at page 19 of Ant Group prospectus. Total payment value was RMB68.5 trillion on an LTM basis at 31 December 2017.

5 As at 30 June 2020. Source: Ant Group prospectus, page 169. RMB2.154 trillion converted to USD at an exchange rate of 0.15.

6 As at 30 June 2020. Source: Ant Group prospectus, page 169. RMB4.099 trillion converted to USD at an exchange rate of 0.15.

7 CLSA.

8 As at 30 June 2020. Source for Ant volumes: Ant Group prospectus, page 168. RMB118 trillion converted to USD at an exchange rate of 0.15. Source for Mastercard volumes: Bloomberg. Mastercard handled $6,326 billion of total card network spending for the trailing 12 month period from 30 June 2020.

9 Source: iResearch report estimating digital payment transaction volumes in China at RMB201 trillion (Ant Group facilitates RMB118 trillion), as cited in Ant Group prospectus, page 176.

10 Ant Group does not disclose contribution margin by division. This assessment is based on our analysis of Ant Group’s prospectus disclosures, including revenues for its “Digital payments & merchant services” division, net of cost of sales (which we allocate on a line-item basis to that division) and an allocation of certain selling & marketing and general & administrative costs to this division. The method of allocation is based on our estimated relationship with revenue generation, informed by Ant disclosures and our own judgement.

11 As at 30 June 2020. Source: Ant Group prospectus, page 166.

12 Calculated on a blended basis as (a) divided by (b) where:

(a) is total digital finance fee revenue only. This is RMB 45,972 million (Ant Group prospectus, page 13) less revenues from its licensed subsidiaries which are not fees of RMB 5,103 million (prospectus, page 16), or RMB 40,869 million for the 6 months ended 30 June 2020. We have then annualised this figure by multiplying by 2.

(b) RMB 6,305 billion in digital finance balances at 30 June 2020 (Ant Group prospectus, page 19).

13 Source: Bloomberg Intelligence, ‘Ant IPO suspension reflects regulatory risks’, 9 November 2020.

Important Information: This material has been prepared by MA Investment Management Pty Ltd (ACN 621 552 896) (“MA Financial Group”), a Corporate Authorised Representative of MA Asset Management Ltd (ACN 142 008 535) (AFSL 327 515). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. This material and the information contained within it may not be reproduced or disclosed, in whole or in part, without the prior written consent of MA Financial Group. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MA Financial Group. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Actual events or results or the actual performance of a MA Financial Group financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MA Financial Group or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MA Financial Group, has any responsibility to update any of the information provided in this material.