The rapid reversal of decades of low interest rates has resulted in financial market uncertainty throughout 2023. Investors are checking-in on portfolio assumptions, seeking defensive investments offering diversification and income security.

Alternative operating assets look increasingly attractive on a relative risk-adjusted basis providing returns less correlated to economic factors and traditional asset classes.

At the core of the investment thesis for Australian accommodation hotels lies the convergence of robust and strengthening market fundamentals, resilient income yield, scalable growth potential and favourable cyclically low asset pricing. When properly executed, and with the benefit of deep operational expertise and asset owner experience, accommodation hotels aim to provide investors with both a resilient and robust income stream as well as a compelling return profile.

What is driving the market metrics and secular dynamics in Australia’s accommodation hotel sector? How does operational real estate add defensive value to a portfolio in an evolving economic environment?

Finding opportunity in alternative assets

Accommodation hotels are historically highly cash-generative operating real assets occupying some of Australia’s prime quality real estate across a wide range of market segments from Economy to Luxury class.1 For investors, mid-scale assets can provide access to well-located, freehold properties in CBDs, while offering outsized yield compared to alternative commercial uses.

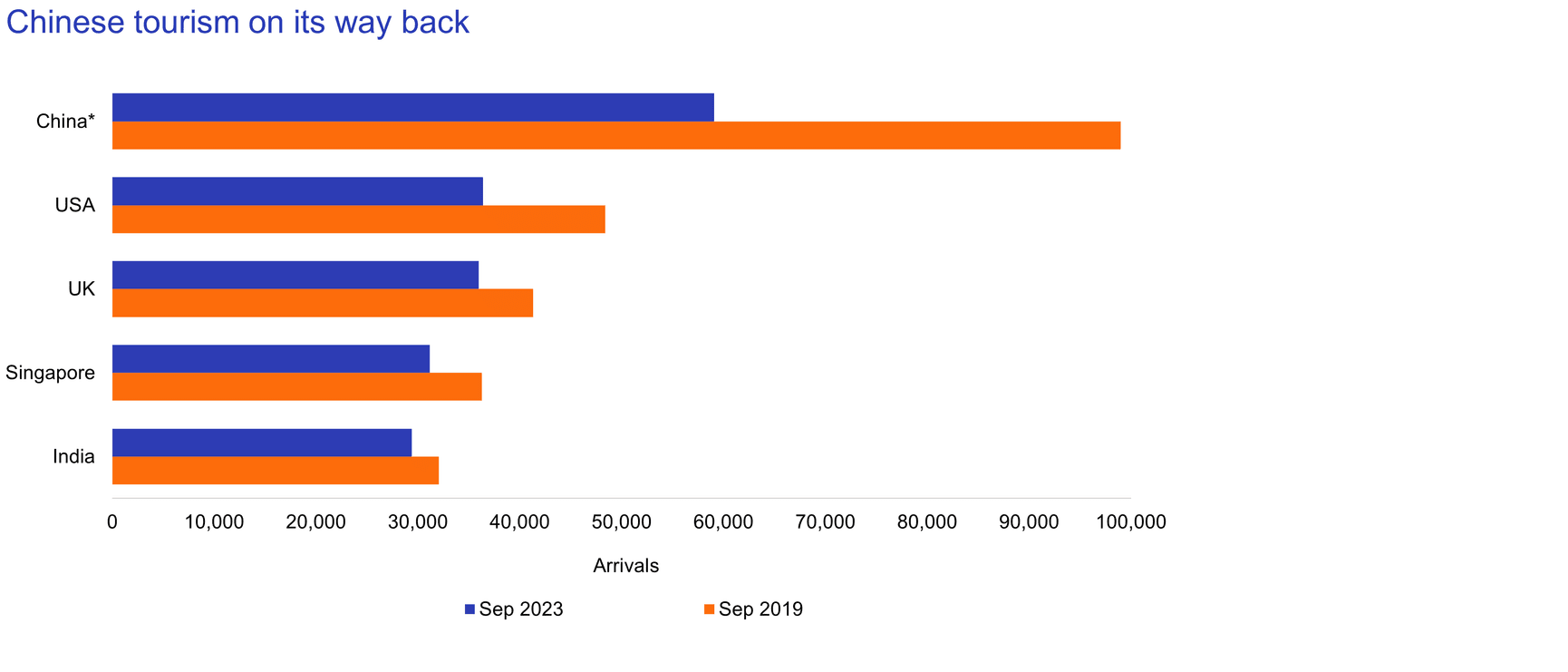

The financial performance of Australia’s accommodation hotel sector strengthened over the year to June 2023 with consistent improvement reported across all major markets.2 Performance continues to surpass pre-pandemic levels in the key metrics of occupancy and revenue, despite restricted inbound Chinese tourism (until recently) and limitations in aviation capacity.3

Source: Australian Bureau of Statistics, Overseas Arrivals and Departures, Australia, www.abs.gov.au. Top five source countries based on month ending September 2023 (excluding New Zealand).

*Excludes SARS and Taiwan.

This impressive story of adaptability, performance and income growth in the face of substantial exogenous challenges underscores the Australian accommodation hotel sector's resilience.

Income resilience in a new era of investing

Experienced asset owners and hotel operators are accustomed to incremental and daily volatility in pricing. Regular mark-to-market of room rates enables accommodation hotel operators to pass through rising costs and provide a resilient income stream. Despite increases in average daily room rates, the year ending June 2023 saw a strong recovery in domestic tourism with spending up 57% and overnight trips up 30%.4

Accommodation hotel owners install and oversee the hotel operator. With active oversight and refinement of operator performance, greater efficiencies and higher margins can be achieved.

When operator contracts become terminable – upon expiry or at other junctures including sale of the asset – the asset owner can extract further upside. This can be done via more favourable contractual terms (renegotiated fees) and ‘key money’, where the operator makes a financial contribution to the asset owner by way of a simple cash payment or contribution to a refurbishment.

In comparison with their luxury counterparts, operators of mid-scale hotels are typically able to turn revenue into profit more efficiently, providing investors with a stable income stream, as well as the opportunity to add value across a wide range of macro conditions.

Income resilience for accommodation hotels is not only derived through operational control. The depth and diversity of short-stay accommodation demand drivers supports stable occupancy levels, supporting income during periods of economic fluctuations. Based on brand positioning and location, hotels which benefit from diverse demand drivers (from both corporate and leisure channels) are likely to provide investors a stable and growing income stream.

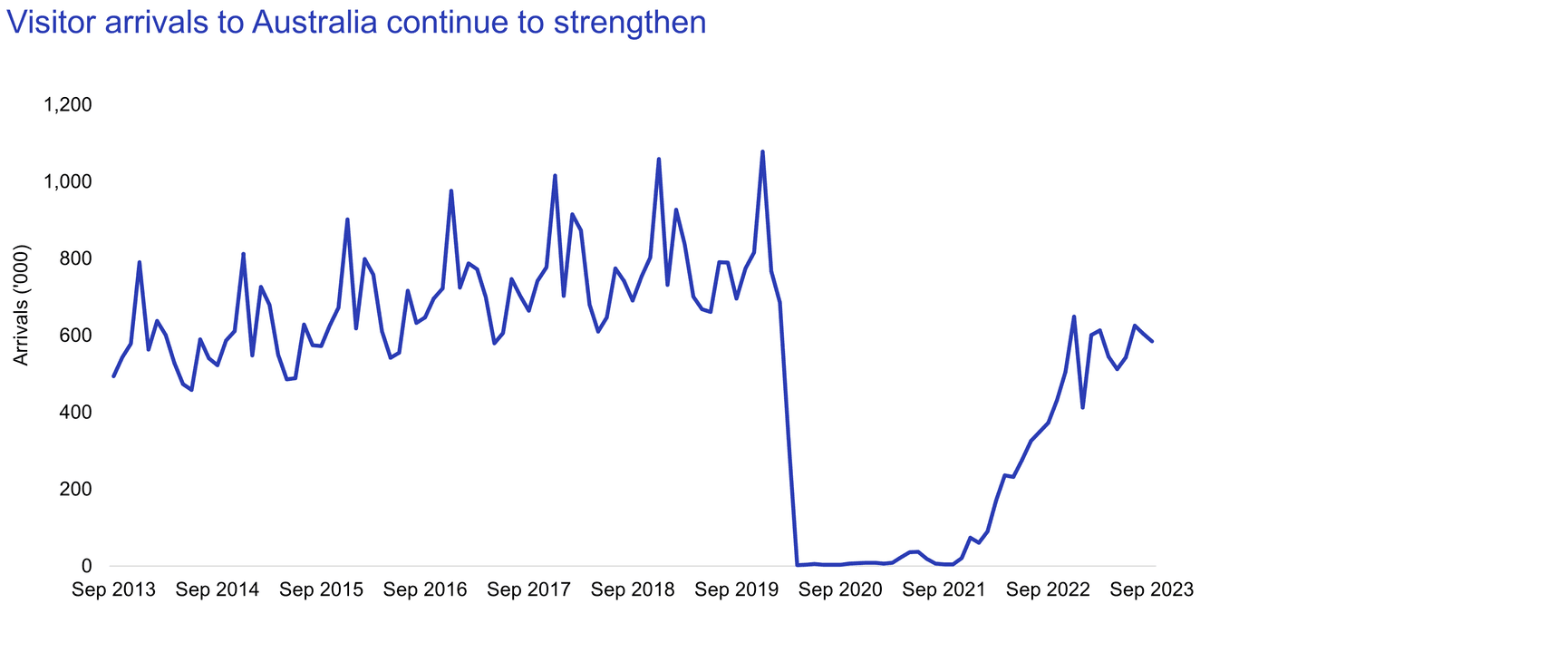

Well-located hotels in Australia’s major CBDs, particularly Sydney, Melbourne, and Brisbane (the 2032 Olympic city), attract broad-based demand from both the corporate and leisure sectors. Tourism Research Australia report Australia’s domestic overnight spend continues to strengthen, with business spend recovering strongly in the most recent National Visitor Survey.5 As aviation capacity into Australia builds and tourism levels rebound strongly (international arrivals remain at 61% of pre-COVID levels) there is significant upside potential for occupancy and income growth.6

Source: Australian Bureau of Statistics, Overseas Arrivals and Departures, Australia, www.abs.gov.au

Up for sale

The Australian hotel market has experienced a considerable level of new supply over the past four years, the majority of which has been absorbed with limited impact on overall occupancy levels.7

As the recent supply cycle comes to an end at the same time as the significant inflation in development costs (particularly construction and finance), new hotel construction is forecast to remain muted. With increased construction costs persisting, values have some way to go before the hotel development equation becomes feasible again. This dynamic should restrict new supply over the medium term.

In addition, the increase in both short and long term interest rates will continue to put pressure on owners who acquired assets in the low interest rate environment that characterised the period between 2017 and 2022. Hotel owners, particularly of assets completed in the last development cycle and without access to new equity, may be forced to sell assets at a discount to replacement value as capital structures become unsustainable.

Compounding the macro and interest rate pressure is the fragmented ownership profile of the Australian accommodation hotel sector. With a large proportion of private owners or assets held in closed-end fund or syndicate structures, the door is open for astute local investors with a deep understanding of market dynamics to acquire properties with fresh capital, offering outsized yields and growth potential.

With favourable and improving market fundamentals on both the demand and supply side and the increasing discrepancy between feasibility assumptions and economic reality for recently completed hotels, opportunities are emerging to secure assets at pricing not seen since the period after the Global Financial Crisis.

Strong fundamentals meet cyclically-low pricing

The shifting economic landscape is creating opportunities for strategic investors with expertise in managing operating real assets (including hospitality, marinas and hotels) to capitalise on changing dynamics in Australia’s accommodation hotel sector, a scalable investment market primed for growth.

For more information about our real estate and hospitality solutions, please get in touch.

- Hotel industry classifications: STR class segments: Luxury, Upper Upscale, Upscale, Upper Midscale, Midscale and Economy. STR definitions, www.str.com

- Australian Accommodation Monitor Summary, Financial-year performance: 2022-2023, www.str.com/whitepaper

- Based on the standard key industry metrics of Occupancy (Rooms sold/Rooms available) and RevPAR (Revenue Per Available Room: Total room revenue divided by the total number of available rooms) STR definitions, www.str.com

- 1H 2023 Highlights, Australian Hotel Market, JLL, www.jll.com.au, National Visitor Survey Results, June Quarter 2023, Australian Trade and Investment Commission, Tourism Research Australia, www.tra.gov.au

- National Visitor Survey Results, June Quarter 2023, Australian Trade and Investment Commission, Tourism Research Australia, www.tra.gov.au

- Australian Bureau of Statistics, Overseas Arrivals and Departures, Australia, Pre-COVID levels refers to 2019 figures. www.abs.gov.au

- Australia’s Hotel Markets, August 2023, CBRE, www.cbre.com.au

Important Information: This material has been prepared by MA Asset Management Ltd (ACN 142 008 535) (AFSL 327 515). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. Any investment in a fund managed by MA Financial Group is subject to the terms and conditions of the relevant fund offer document. This material and the information contained within it may not be reproduced or disclosed, in whole or in part, without the prior written consent of MA Asset Management Ltd. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MA Asset Management Ltd. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Actual events or results or the actual performance of MA Asset Management Ltd or an MA Asset Management Ltd financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MA Asset Management Ltd, MA Financial Group or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MA Asset Management Ltd and MA Financial Group, has any responsibility to update any of the information provided in this material.