“I have no desire to suffer twice, in reality and then in retrospect.”

― Sophocles, Oedipus Rex

As investors we take positions with foresight but are judged from hindsight. So come 2030, how will you judge your investment decisions during the COVID-19 dislocation?

A market dislocation may be defined as a material deviation from a long-term trend. If so, by definition, a severe dislocation simply increases the size of the readjustment required to return to-trend.

It follows that the potential returns while investing during a dislocation event exceed investing during normalised periods. For this reason, many investors have become amateur epidemiologists and macro-economists.

In the absence of personal credibility on either subject, I thought it interesting to share some charts which recently crossed my desk.

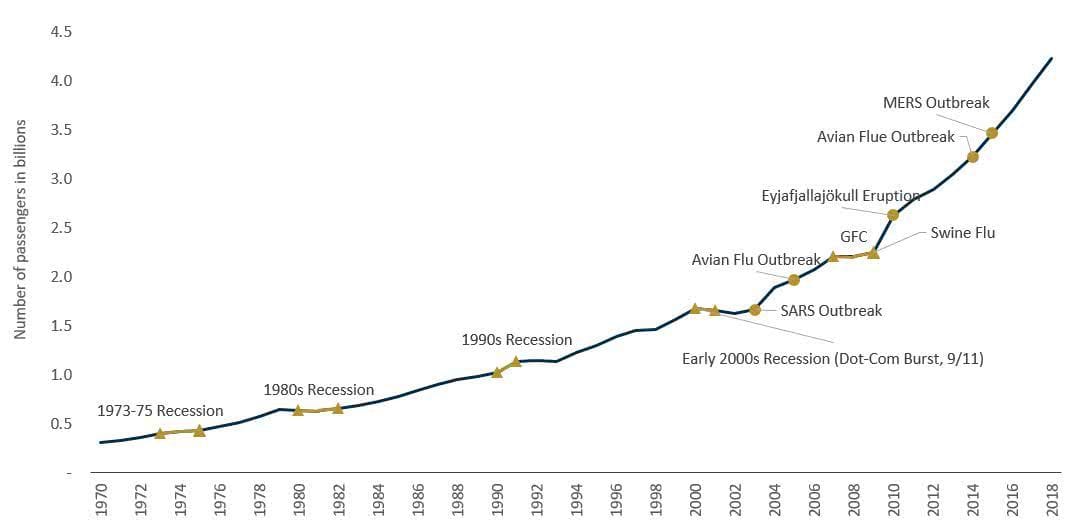

Chart 1 – Global Air Passenger Traffic, 1970-2018

Source: World Bank, International Civil Aviation Organisation, MA Financial Group.

A shift in paradigm or volatility against a trend?

The spark of the current dislocation is COVID-19, the tinder is the restriction on the free movement of consumers and service providers, and the remedy will ultimately be the reinstatement of safe movement concurrent with a recovery of economic confidence.

If we use global air travel as an indicator, we can see from the chart above the relatively consistent growth over the past 50 years. One can assume this has been underpinned by the desirability of travel in conjunction with improving affordability.

The consistency has been interrupted mostly by economic factors. Arguably, the interruption in 2000 was longer due to the dual impact on desirability (safety concerns post 9/11) and affordability (many economies were in recession).

From a globally aggregated perspective, COVID-19 should be expected to cause a more prolonged interruption due to the compounding impacts of economic recession on affordability and the drawbacks of being enclosed in a confined space. But, as we have seen in the past, the interruptions are simply periods of volatility along an inter-generational trend.

Our key risk against a mean-reversion hypothesis would be a shift in paradigm implying a new trend line.

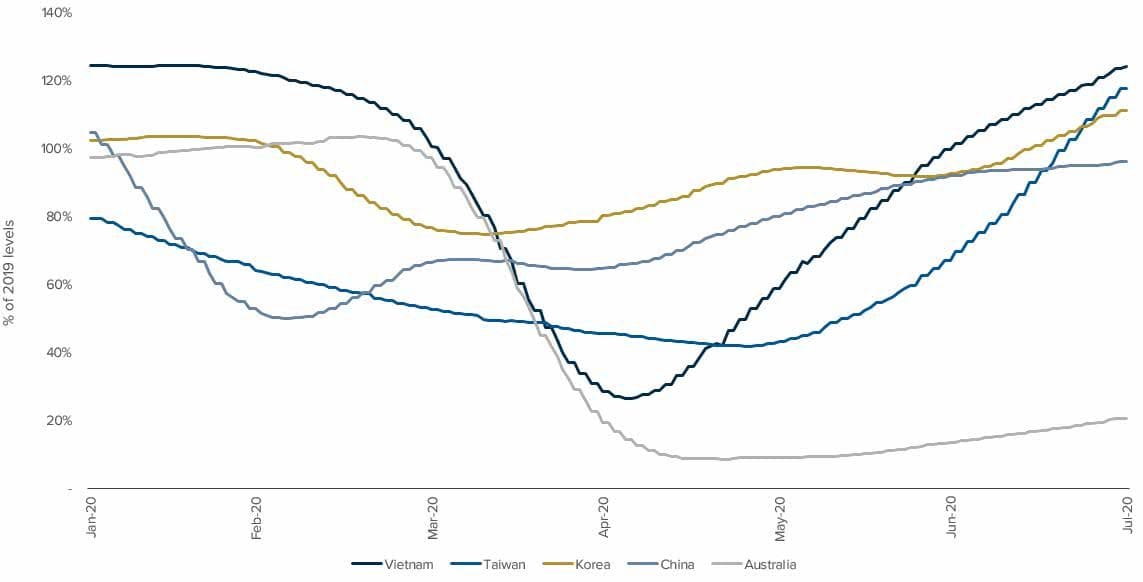

Chart 2 – 2020 Air Travel vs 2019

Source: SRS Analyser. Indicative only.

Our second chart considers domestic travel. Here we see that inflection has already occurred in many nation-markets to pre-pandemic levels. Australia’s domestic travel recovery has been an unfortunate victim of a decoupling of the states, however as we revert towards a borderless commonwealth we would expect to see a corresponding trajectory.

A medium-term perspective is key to investing in the current (COVID-19) environment

History tells us that dislocation caused by COVID-19 will end. It may not be quick, but mean reversion is inevitable. Businesses with a strong foundation of real assets or intellectual property, paired with a resilient capital and operating structure, will recover.

For investors, being able to identify (or selecting a manager able to identify) the right opportunities is key.

Taking an active investment approach in 2020, rather than sitting passive in cash, is more likely to allow us to look favourably, with hindsight, on our COVID-19 investments decisions come 20301.

Please get in touch to arrange a discussion, and to learn more about our investment solutions designed to capitalise on current market dislocation.

1. We are not suggesting investment in airlines!

Important Information: This material has been prepared by MA Investment Management Pty Ltd (ACN 621 552 896) (“MA Financial Group”), a Corporate Authorised Representative of MA Asset Management Ltd (ACN 142 008 535) (AFSL 327 515). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. This material and the information contained within it may not be reproduced or disclosed, in whole or in part, without the prior written consent of MA Financial Group. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MA Financial Group. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Actual events or results or the actual performance of a MA Financial Group financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MA Financial Group or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MA Financial Group, has any responsibility to update any of the information provided in this material.