In the current environment characterised by economic uncertainty many investors are risk-conscious and searching for certainty and stability.

Real estate investments have historically delivered defensive and reliable cash flows. In particular, the Australian industrial and logistics real estate sector has demonstrated strong growth and resilience in recent years which is expected to continue.

This growth is underpinned by a range of positive long-term structural trends including the continued rise and development of e-commerce, last-mile logistics, growing occupier investment, national infrastructure investment and surplus institutional demand.

The shift to e-commerce

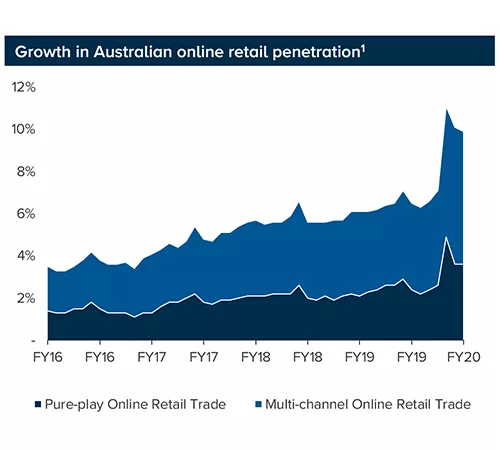

Evolving consumer behaviour is driving growth in e-commerce globally.

The shift toward online retailing is currently more advanced internationally highlighting Australia’s growth potential.

Online retail accounts for 12% and 24% of total retail sales in the United States and United Kingdom respectively1, compared to just 10% in Australia.2

To accommodate this shift to online, retailers must improve logistics efficiencies and increase warehousing networks to store inventory, manage deliveries, and process returns. According to Prologis Inc. analysis, e-commerce requires three times as much space as bricks and mortar retail3.

Integrated logistics networks

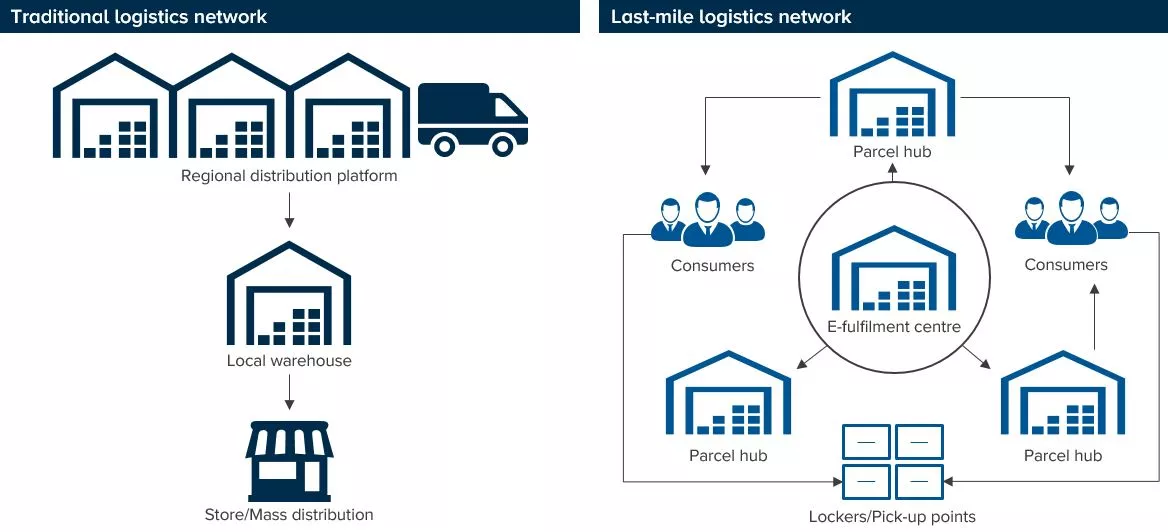

Australian retailers have trended towards `last-mile logistics’ – transporting packages from distribution centres to consumers as quickly as possible, and in response to expectations of fast delivery times.

This has meant linear distribution processes of traditional logistics operators have been replaced by a more integrated network of smaller fulfilment centres and parcel hubs.

The integrated network improves efficiencies between regional distribution centres, local warehousing and the consumer helping to fast-track deliveries.

This approach has increased the demand for smaller logistics facilities to complement larger distribution centres.

Rising expectations of fast deliveries driving a move from linear to integrated distribution networks

Growing occupier investment

In response to greater inventory demands and logistics efficiencies, occupiers are investing significant capital in new technologies and automated solutions within their industrial and logistics footprint.

As a result, the sector is characterised by modern facilities with long leases and low vacancy attributes which underpin stable returns.

National infrastructure investment

The health of the industrial and logistics sector is closely aligned to infrastructure spending.

Across Australia there are over $100 billion of multiple landmark projects, developments and transport upgrades that have been identified to occur over the next decade4.

Surplus institutional demand

Favourable structural tailwinds are being underpinned by the growing institutionalisation of ownership and management away from a largely corporate and private base.

Colliers International have estimated $26 billion worth of domestic and global capital is looking to be placed in Australian industrial and logistics assets.5 This is over seven times the supply of ~$3.6 billion of assets trading at $10 million plus in 2020 (through to September 2020).6

This mismatch in demand and supply presents positive conditions for future capital growth.

Please get in touch to arrange a discussion, and to learn more about our investment solutions designed to capitalise on the Australian industrial and logistics real estate sector.

1. Colliers International Research.

2. Australian Bureau of Statistics.

3. Prologis - COVID-19 Special Report #5.

4. Department of Infrastructure, Transport, Regional Development and Communications.

5. Colliers Research, Industrial Second Half 2020. 6. Colliers International, Industrial Cap Rate Analysis, Post A-REIT Reporting Season - September 2020.

Important Information: This material has been prepared and issued by MA Investment Management Pty Ltd (ACN 621 552 896) (“MA Financial Group”), a Corporate Authorised Representative of MA Asset Management Ltd (ACN 142 008 535) (AFSL 427 515). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. This material and the information contained within it may not be reproduced or disclosed, in whole or in part, without the prior written consent of MA Financial Group. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MA Financial Group. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Actual events or results or the actual performance of a MA Financial Group financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MA Financial Group or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MA Financial Group, has any responsibility to update any of the information provided in this material.