Significant Investor Visa (188C) & Investor Visa (188B)

Overview

As one of Australia’s largest Significant Investor Visa (SIV) and Investor Visa (IV) fund managers, MA Financial Group helped pioneer the program, working closely with Australian federal and state governments. Forming part of our Asset Management division, our specialist SIV client team spans Sydney, Melbourne and Hong Kong, offering a range of investment solutions to high-net-worth investors.

The SIV and IV programs

The Significant Investor Visa was introduced by the Australian Government in 2012 as a way to boost the economy, and drive innovation by attracting high-net-worth individuals from other countries seeking permanent residency in Australia.

In July 2021 the Australian Government changed the investment framework for Investor Visa applicants who are now required to invest in the same complying investment framework as the SIV.

The SIV and IV are streams within the Australian Government's Business Innovation and Investment (Provisional) (Subclass 188) visa, and the Business Innovation and Investment (Permanent) (Subclass 888) visa.

Benefits of choosing MA Financial Group

Market leader

SIV pioneer in Australia and a SIV market leader

Experience

Experienced manager having helped hundreds of applicants with their complying investments

Proven success

Performance track record

Expertise

ASX listed company with strong financial backing

The visa application process

Immigration agent

Expression Of interest (EOI)

Apply online via Skill Select on the Australian Government website

State Nomination

Nomination is required from an Australian state or territory, or Austrade (for the SIV only)

Visa application submitted to Australia Department of Home Affairs (DHA)

- Application form

- Medical checks

- Background police check

- Source of funds (SOF) check

MA financial group

Invitation to make complying Investment

Investor transfer of specified funds to fund manager

PR / 888 Visa

- Maintain complying investment

- Spend required number of days in in Australia over 5 years

- Investors may apply for permanent residency after 3 years if they have fulfilled the residency requirement at this time

- Meet nominating state’s requirements

SIV and IV complying funds

The SIV and IV complying investment rules were changed by the Australian Government in July 2021. MA Financial Group offers funds that are complying investments for the purposes of SIV and IV, both before and after 1 July 2021. The date of your visa application will determine which set of rules apply to you. Please always refer back to the relevant government website for any further information or updates to the complying investment rules.

Department of Home Affairs - Significant Investor Stream

Department of Home Affairs - Investor Stream

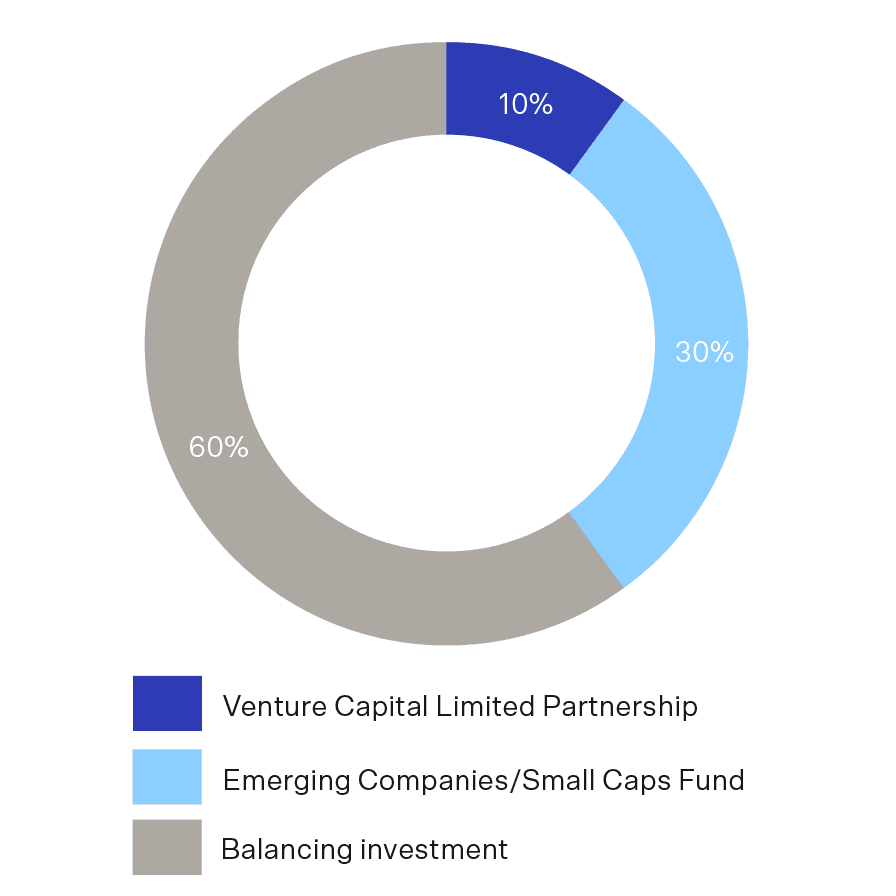

188C Before July 2021

Venture Capital Limited Partnership (VCLP) Mandatory 10%

Mandatory minimum investment of at least 10% ($500,000) into a venture capital or private equity fund. MA Financial Group offers an unconditionally registered Australian domiciled Venture Capital Limited Partnership (VCLP) that’s been designed specifically for SIV and IV investors. The VCLP targets Australian-based private companies (unlisted) across a range of industries, including agriculture, technology, food, health, education and tourism.

Emerging Companies/Small Caps Fund Mandatory 30%

Mandatory minimum investment of at least 30% ($1.5 million) in a managed fund that invests in Australian Emerging Companies (“Small Caps”). Investments must focus on ASX-listed companies that have a market capitalisation of less than $500 million, however, a maximum of 20% can be invested in Australian unlisted companies.

Balancing Investment 60%

The Balancing Investment allows a maximum of 60% ($3.0 million) to be invested in managed funds investing in commercial property, corporate bonds or listed equities. MA Financial Group offers a range of investment options across all asset classes.

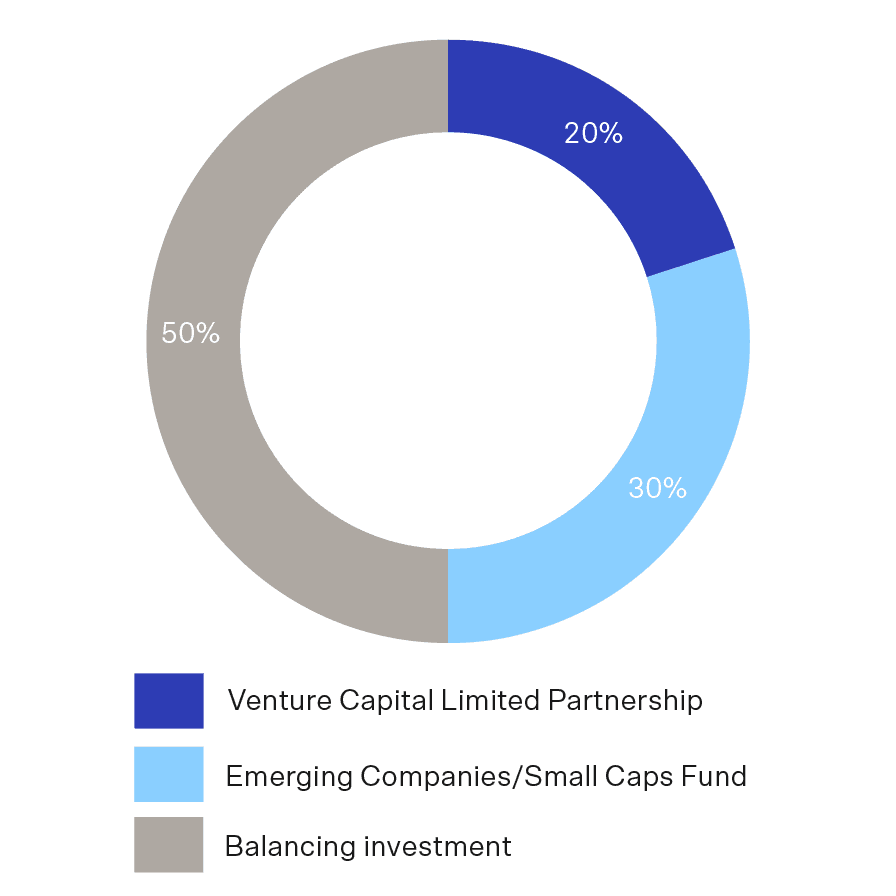

188C post July 2021

Venture Capital Limited Partnership (VCLP) Mandatory 20%

Mandatory minimum investment of at least 20% ($1.0 million) into a venture capital or private equity fund. MA Financial Group offers an unconditionally registered Australian domiciled Venture Capital Limited Partnership (VCLP) that’s been designed specifically for SIV and IV investors. The VCLP targets Australian-based private companies (unlisted) across a range of industries, including agriculture, technology, food, health, education and tourism.

Emerging Companies/Small Caps Fund Mandatory 30%

Mandatory minimum investment of at least 30% ($1.5 million) in a managed fund that invests in Australian Emerging Companies (“Small Caps”). Investments must focus on ASX-listed companies that have a market capitalisation of less than $500 million, however, a maximum of 20% can be invested in Australian unlisted companies.

Balancing Investment 50%

The Balancing Investment allows a maximum of 50% ($2.5 million) to be invested in managed funds investing in commercial property, corporate bonds or listed equities. MA Financial Group offers a range of investment options across all asset classes.

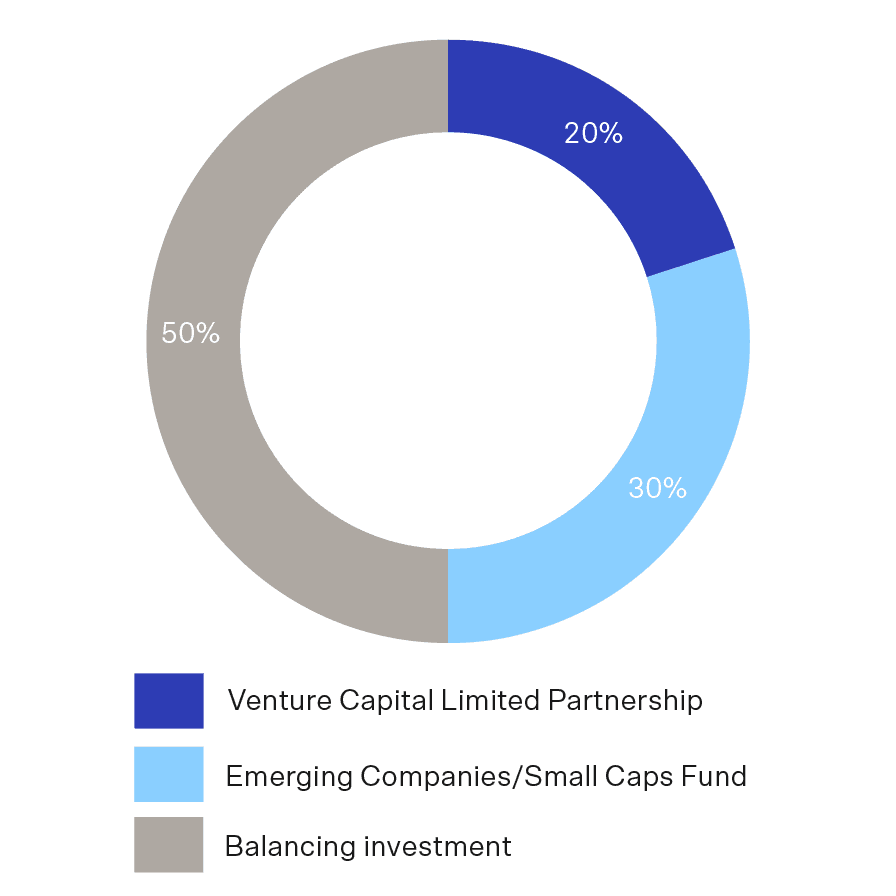

188B post July 2021

Venture Capital Limited Partnership (VCLP) Mandatory 20%

Mandatory minimum investment of at least 20% ($500,000) into a venture capital or private equity fund. MA Financial Group offers an unconditionally registered Australian domiciled Venture Capital Limited Partnership (VCLP) that’s been designed specifically for SIV and IV investors. The VCLP targets Australian-based private companies (unlisted) across a range of industries, including agriculture, technology, food, health, education and tourism.

No property and development or land ownership, finance, insurance, construction or passive investments.

Emerging Companies/Small Caps Fund Mandatory 30%

Mandatory minimum investment of at least 30% ($0.75 million) in a managed fund that invests in Australian Emerging Companies (“Small Caps”). Investments must focus on ASX-listed companies that have a market capitalisation of less than $500 million, however a maximum of 20% can be invested in Australian unlisted companies.

Balancing Investment 50%

The Balancing Investment allows a maximum of 50% ($1.25 million) to be invested in managed funds investing in commercial property, corporate bonds or listed equities. MA Financial Group offers a range of investment options across all asset classes.

Restriction on cash (Max. 20%) and residential real estate.

Resources

Associations

MA Financial Group Asset Management is proud to be a member of the following associations:

For more information and to arrange a discussion, please contact us.