Hotels, or pubs as they are commonly referred to, are an integral part of the local communities in which they operate.

As an investment they are high volume, defensive and cash generative businesses underpinned by diverse earning profiles and resilient earnings streams.

Because of this, investing in hotels offers resilient and sustainable income through the potential for regular and growing distributions, capital growth over the investment term and the potential for refurbishment or redevelopment of the venues themselves to increase land utilisation.

Key fundamentals driving demand

Pubs have always served as a central meeting point for local communities in Australia.

The post COVID-19 recovery has reinforced the deep sense of connection that customers and communities have towards their local pub. We saw this evidenced through the uptick in Redcape’s operating EBITDA1 upon re-opening following the COVID-19 shut down.

Pub assets, specifically those owned by operators that also own the associated land, buildings and business are in high demand due to favourable consumer sentiment, attractive growth in earnings and high barriers to entry.

Quality hotel operators are those able to invest and drive cash flow and improvements over time.

COVID-19 and the future of pubs

With continuing record low interest rates, institutional demand for real estate across most subsectors and in particular industrial, logistics and retail, has been strong as investors seek to acquire assets which provide consistent, defensible income with long-lease provisions.

Consistent with this broader sector demand, pubs have likewise been seen as attractive assets for not only wealthy families, but corporate and institutional asset owners. And while COVID-19 has undoubtedly provided a disruption to the pub and hospitality sector more broadly, this hasn’t diminished demand.

Though the COVID-19 pandemic, we have seen huge and growing support for hotel and leisure-focused assets underpinned by land ownership. In particular, venues that make a positive impact on their local communities by offering a bespoke, relevant and enhanced customer experience.

Demand pouring in

In 2021, a record $2bn of pub assets traded in Australia off the back of positive sentiment following 2020s extensive lockdowns.2

Demand for assets, particularly in regions such as Byron Bay, has been strong with investors in the hospitality sector focused on the development of under-utilised sites to meet the accommodation shortages and mixed food and beverage offers.3

An independent valuation of MA Hotel Management’s Beach Hotel in Byron Bay was undertaken in December 2021, which has valued the asset at $135m, a 29.8% increase from the Freehold Going Concern valuation of $104m at the time of acquisition in February 2020.

This same trend is supported by the demand for coastal lifestyle locations including Byron Bay, which have led the way as NSW residential land values surged 25% to $1.8 trillion in the 12 months to July 2021.4

Demand for Sydney metropolitan pubs, particularly those with gaming, has continued to increase in recent years. This has been amplified in areas where hospitality assets have been tightly held and there is lack of supply. Yields are broadly in the range of 6.0% - 8.0%, trending below their 2007 peak which is typical in a buoyant market, with future value performance tied to asset performance and management.

We believe quality assets managed by hotel operators with strong balance sheets, well-established cultures, agile responsiveness to changing conditions and who truly understand their people, customers and investors will perform well into the future.

For more information about our hospitality capabilities and solutions, please get in touch.

About MA Hotel Management

Part of MA Financial Group, MA Hotel Management is the investment manager and operator of hotel assets and Redcape Hotel Group.

MA Hotel Management is one of Australia's leading hotel managers, and since July 2017 has successfully completed numerous refurbishment projects across its portfolio to improve asset quality, re-establish venues as community-centric hubs and increase the growth profile for investors.

Unique to MA Hotel Management is its Public Communities platform, designed to enrich the lives of customers by creating relevant and local opportunities for social connection and to contribute positively to their local community. This is achieved through providing customers with ways to make their leisure time count towards local initiatives of their choice. We understand enriching the wellbeing of our communities directly correlates to the wellbeing of our customers which is a driver for growth.

MA Hotel Management's portfolio

Currently MA Hotel Management manages 40 community hotels5 across the eastern seaboard of Australia with a combined turnover in excess of $363 million6 of which food, beverage and off-premise retail bottle shops and other revenue represent 43% (or $155 million) of total revenue.

Venues include the Byron Bay Beach Hotel, Hotel Brunswick, and Eastwood, Cabramatta and the Keighery Hotels.

How MA Hotel Management adds value

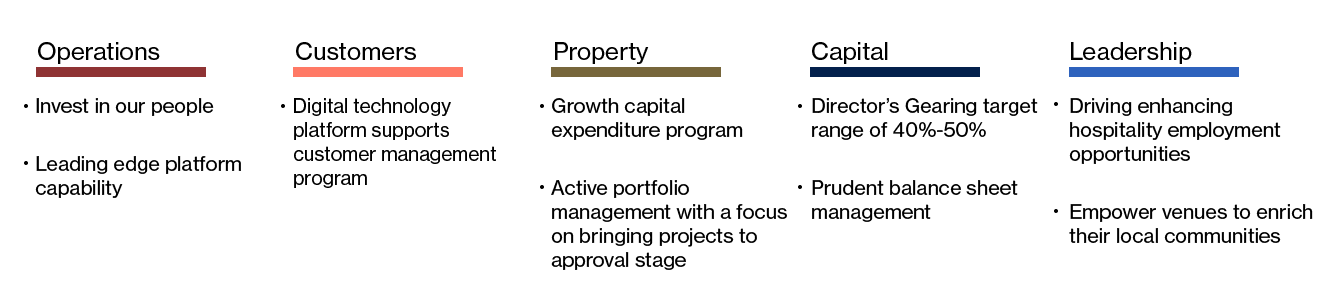

MA Hotel Management has a platform for delivering sustainable distributions for investors. This is achieved through five strategic growth drivers.

1. Operating EBITDA of $17.6m in Q2FY22 versus $16.8m in the prior year despite NSW venues only re-opening 2 weeks into the period being from 11 October 2021. These metrics are unaudited and non-IFRS measure

2. Australian Financial Review, 2021

3. Recent transactions include Shaws Bay Hotel and Fenwick House – 6500sqm site located at 3 Bright Street Ballina (sold for $31million in November 2021), Lennox Hotel – located at Pacific Parade and Byron Street, Lennox Head (sold for $40million in February 2021), Cheeky Monkey’s backpackers bar – located at 16 Lawson Street, Byron Bay (sold for $13 million in May 2021) and Great Northern Hotel – located at 35/43 Jonson St, Byron Bay (sold for circa $80 million in July 2021)

4. NSW Valuer-General’s annual report

5. MAHM’s portfolio consists of 38 Freehold Going Concerns and 2 Leasehold Going Concerns

6. FY21 revenue includes Redcape Hotel Group, Beach Hotel Byron Bay and Taylor Square Fund from acquisition at February 2021.

Important Information: This material has been prepared by MA Hotel Management Pty Ltd (ACN 619 297 228) (“MAHM”), a Corporate Authorised Representative of MA Asset Management Ltd (ACN 142 008 535) (AFSL 327 515). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. Any investment in a fund managed by MA Financial Group is subject to the terms and conditions of the relevant fund offer document. This material and the information contained within it may not be reproduced or disclosed, in whole or in part, without the prior written consent of MAHM. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MAHM. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Actual events or results or the actual performance of MAHM or an MA Financial Group financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MAHM, MA Financial Group or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MAHM and MA Financial Group, has any responsibility to update any of the information provided in this material.