The Australian industrial and logistics real estate sector has demonstrated strong growth and resilience in recent years which is expected to continue.

In particular, the refrigerated logistics sector continues to go from strength to strength while showing strong resilience throughout the COVID-19 period.

This strength can be attributed to a range of positive underlying trends including higher occupier demand, domestic supply imbalances, high barriers to entry and a rise in e-commerce.

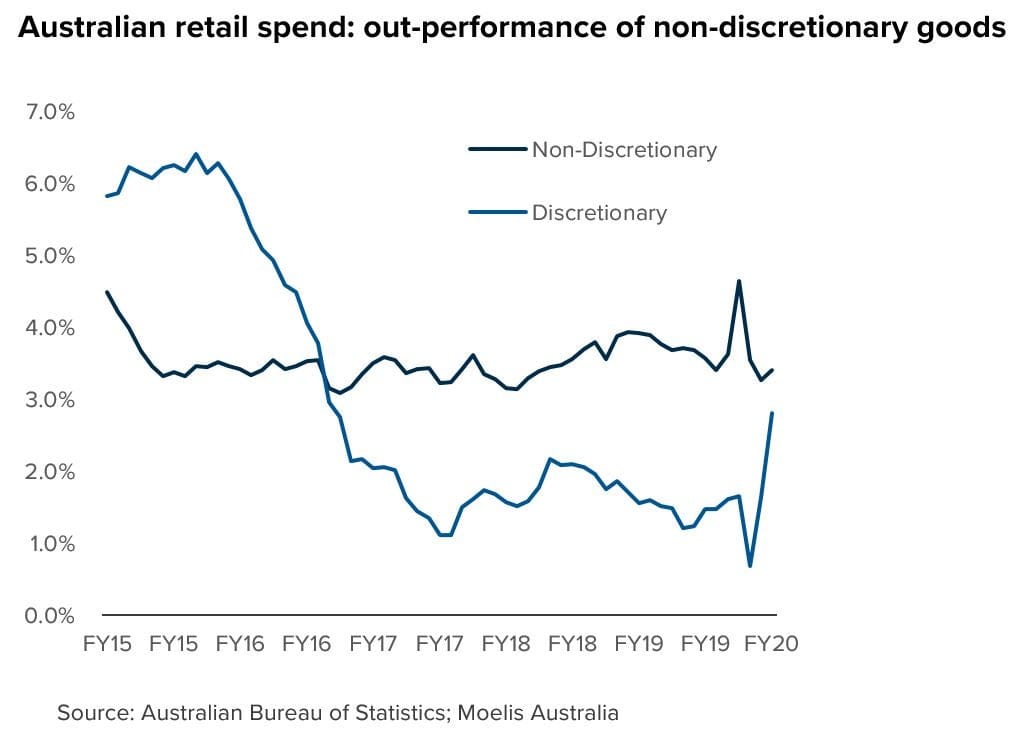

Non-discretionary goods driving occupier demand

The sector benefits from its users being in the business of delivering non-discretionary goods to consumers.

To do this, it is imperative for these businesses to store items such as groceries, healthcare products, chemicals and wines in temperature-controlled warehouses within close proximity to their markets.

Importantly and despite the disruption of e-commerce, this requirement is not likely to change and Australia’s population growth indicates continued demand over the long term.

Australia’s supply shortfall relative to global peers

Australia has significantly less cold storage capacity compared to the rest of the world.

In 2018 the Global Cold Chain Alliance issued a Cold Storage Capacity Report which identifies Australia as having a relatively low temperature-controlled warehousing capacity per person compared to international peers.

This same finding was also highlighted in research by JLL who advise that Australia’s 2018 capacity of 0.085 cubic metres per urban resident is less than half the world average of 0.2 cubic metres.1

This shortfall of circa 2.5 million cubic metres will continue ensure vacancy remains low and market rental growth is maintained.2

High cost of capital creating barriers to entry

The complexity and therefore cost associated with building and operating a cold storage facility is far greater than conventional dry warehouses.

Upfront investment is typically two to three times more than a dry warehouse, and construction can take up to six months longer.3

Delivering a refrigerated facility requires considerable additional mechanical services and structural enhancements to ensure appropriate insulation.

The high cost associated with building these additional elements creates a barrier to entry and aids in preventing oversupply.

An additional consequence of this high capital cost is that tenants and landlords require longer leases in order to amortise the cost at a sensible rate.

Furthermore, given the high cost to relocate, the market is characterised by high lease expiry retention rates and low vacancy rates.

Rise in e-commerce increasing storage times

Like the wider industrial market, the cold storage sector is a major benefactor from the rise in e-commerce. Online retailing typically has longer warehouse inventory storage periods compared to traditional brick-and-mortar retailers.

Furthermore, with businesses (in particular, in the pharmaceuticals sector) re-evaluating risk management practices to buffer global trade disruptions, this is only likely to put further pressure on increased storage times and ultimately occupier demand.

A well-positioned sector

The outcome of the combination of these underlying trends is evidenced by recent JLL research noting that vacancy in cold storage has reduced to less than one per cent in response to the relatively low level of supply, rising demand for food preservation and supply chain complexities).3

The sector is well-positioned to continue on an upward growth trajectory and is increasingly being sought by institutional investors.

Please get in touch to arrange a discussion, and to learn more about our investment solutions designed to capitalise on the Australian industrial and logistics real estate sector.

1. CBRE Asia Pacific Cold Storage “An Investor’s Guide’.

2. JLL Market Overview, 2018.

3. JLL Research January 2021.

Important Information: This material has been prepared and issued by MA Investment Management Pty Ltd (ACN 621 552 896) (“MA Financial Group”), a Corporate Authorised Representative of MA Asset Management Ltd (ACN 142 008 535) (AFSL 427 515). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material is intended for wholesale investors only as defined under the Corporations Act 2001 (Cth) and for informational purposes only. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. Any investment in a fund will be solely on the basis of the relevant information memorandum for that fund (as updated and amended from time to time). This material and the information contained within it may not be reproduced or disclosed, in whole or in part, without the prior written consent of MA Financial Group. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MA Financial Group. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Actual events or results or the actual performance of a MA Financial Group financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MA Financial Group or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MA Financial Group, has any responsibility to update any of the information provided in this material.