Real estate has proved to be one of the most resilient and best risk adjusted performing investment classes in Australia since the early 1900’s.

Retail real estate in particular offers investors an attractive counter-cyclical investment opportunity, underpinned by a range of strong underlying trends.

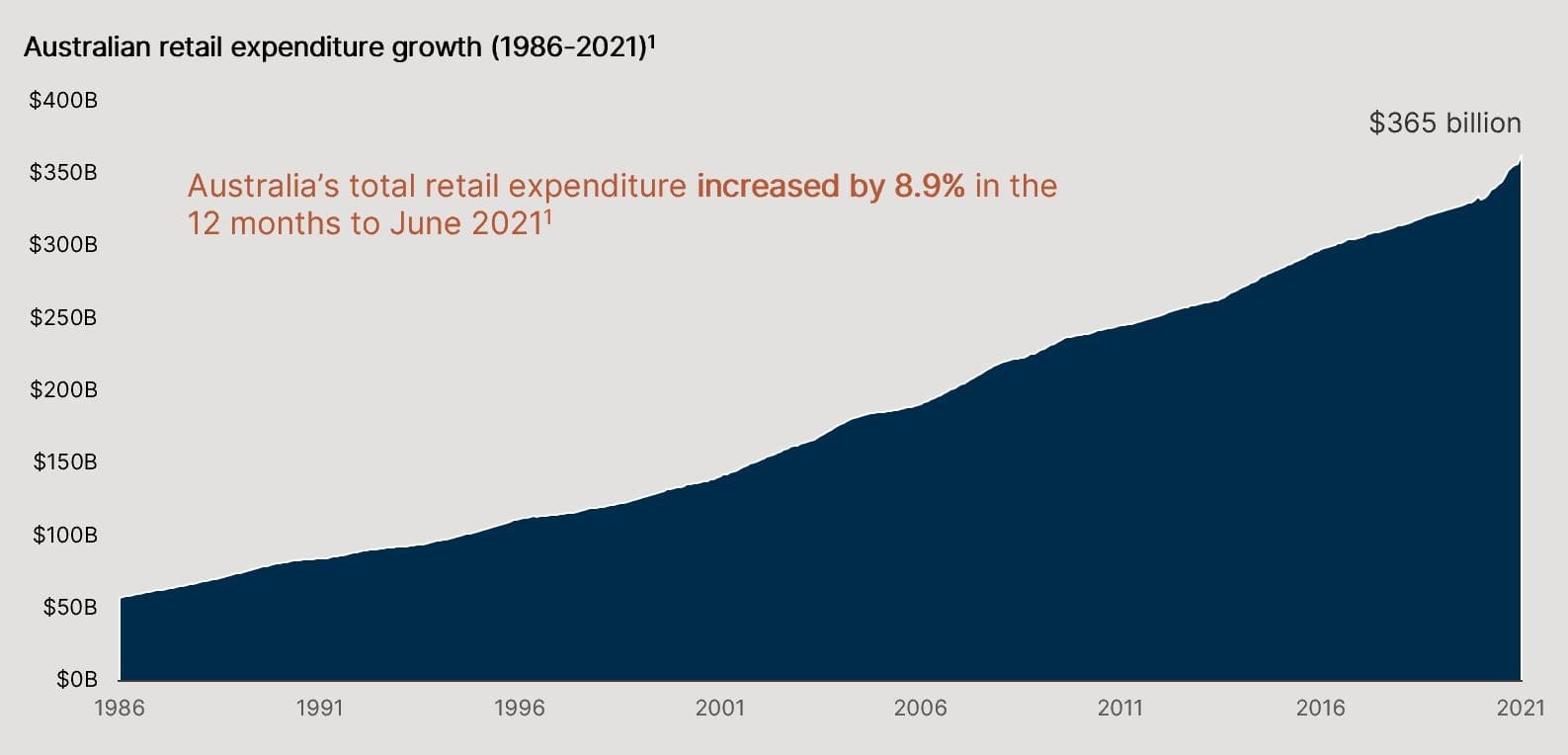

Long history of consistent and resilient retail sales growth

The sector has been underpinned by a long history of consistent, resilient and solid growth in retail sales.

Over the past five decades or more, the Australian Bureau of Statistics have not recorded a single year of negative retail expenditure growth – including during periods of economic uncertainly.

In the 12 months to December 2020 retail expenditure grew 10% despite significant COVID-19 related disruptions. During the global financial crisis retail expenditure grew on average 12% p.a. between 2007-2009, despite increasing unemployment and sharp corrections in equities markets.

1. Australian Bureau of Statistics.

People and food the key drivers

Australia’s high population growth has been a catalyst for this increase, and has supported non-discretionary retail categories such as food in particular.

Since 1982, ‘Total Food Retailing’ and ‘Total Cafes, Restaurants and Other Takeaway Food’ have delivered the highest average annual growth rates of 6.3% and 6.6% p.a., respectively.1

Australian shopping centres, anchored by national supermarket retailers such as Coles and Woolworths, account for a significant portion of total retail sales.

Low supply, high barriers to entry

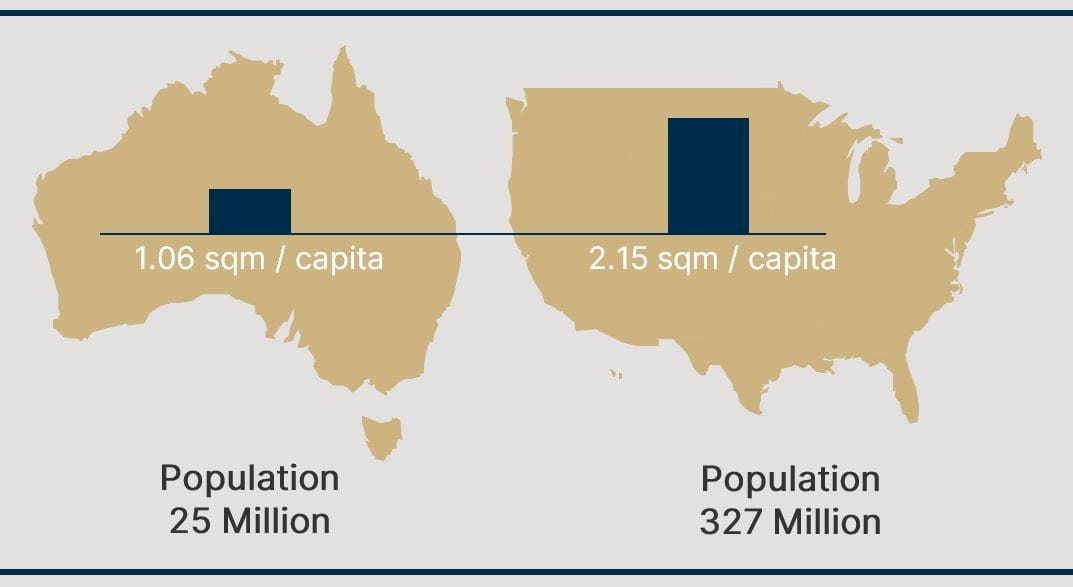

The Australian retail market exhibits very different characteristics to other retail markets around the world, in large part due to the high barriers to entry but also comparative low supply versus the major markets of North America.

Less than half the supply of the US

Australia has retail supply of approximately 1.06sqm per person compared to the US which has more than double this.

Retail space provision - Australia vs United States

Source: Shopping centre council of Australia.

Restrictive zoning regulations

In Australia, the supply of new retail floorspace per additional person has been decreasing – from 2.6sqm p.a. in 1995-1999 to 1.1sqm p.a. between 2015-2019.

This reduction can be attributed to the fact the supply of new retail floorspace in Australia is tightly controlled by restrictive zoning regulations, and our high population growth has led to greater emphasis on residential planning schemes.

This restricts the ability to develop new retail shopping centres in established metropolitan areas, meaning new retail supply is often introduced into high residential growth areas along the metropolitan periphery which has no material long-term impact on established shopping centres.

High occupancy rates, diversified tenant base

Occupancy rates for Australian retail assets are high, with a national average vacancy rate of only 6.9% and a 10-year average of 4.2%.2

Retail assets are assisted by the diversity of their tenant base. While Australian shopping centres are generally anchored by the major supermarkets and often discount department stores, the sub-regional and regional centres also have a diverse range of smaller tenants reducing the exposure to any individual tenant.

Strong and resilient Australian economy

The strength in the retail sector is supported by a strong and resilient Australian economy.

Until the exceptional circumstances brought on by COVID-19 in 2020, Australia had not experienced a recession since 1991.

The economy has been driven by strong population growth, increasing productivity and access to in-demand natural resources. It remains a highly desirable destination due to our favourable standards of living, including a top tier medical system, stable governance and strong agricultural production.

The sector is well positioned to continue on an upward growth trajectory and is increasingly being sought by institutional investors.

Please get in touch to arrange a discussion, and to learn more about our investment solutions designed to capitalise on the Australian retail real estate sector (available to wholesale investors only).

1. Australian Bureau of Statistics.

2. JLL Research.

Important Information: This material has been prepared by MA Investment Management Pty Ltd (ACN 621 552 896) (“MA Financial Group”), a Corporate Authorised Representative of MA Asset Management Ltd (ACN 142 008 535) (AFSL 327 515). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material is intended for wholesale investors only as defined under the Corporations Act 2001 (Cth) and for informational purposes only. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. Any investment in a fund will be solely on the basis of the relevant information memorandum for that fund (as updated and amended from time to time). This material and the information contained within it may not be reproduced or disclosed, in whole or in part, without the prior written consent of MA Financial Group. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MA Financial Group. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Actual events or results or the actual performance of a MA Financial Group financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MA Financial Group or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MA Financial Group, has any responsibility to update any of the information provided in this material.